Price forecast from 10 to 14 of October 2022

10 October 2022, 14:44

-

Grain market:

Everything is fine. Hello everybody!

Unfortunately, the grain market has ceased to be a sacred cow for Western psychopathic politicians. It does not matter that someone somewhere does not get their piece of bread, despite the fact that there is no shortage. The main thing is to prevent Russia from exporting its agricultural products normally.

The other day we got a precedent when grain of Russian origin was not presented at the tender in Iraq. This was a condition for the participation of companies from Ukraine, Canada, the USA and other countries. If this trend gains momentum, it will become more difficult to export grain. While we have Egypt and Turkey, they are also under pressure. Under the current circumstances, it is difficult to expect high grain prices within the country.

There is nothing about agriculture in the eighth package of sanctions against Russia that the European Union introduced against Russia, but this does not mean that in the spring, for example, the ninth package will not contain something related to fertilizers, pesticides, seeds, and further down the list, which will eventually become not good at all, and not only in Russia.

The grain market may correct, but not more than 10% in the current environment. There won’t be a big fall in the next few months.

Energy market:

Expensive energy resources in Europe are forcing corporations to move production to the US and China. Burgomasters in cities put out lights and advertising. Washington is quietly furious about the reduction in oil production by OPEC +. Norway earns on the supply of gas beyond measure. And she will earn even more, and not only she alone. Winter is coming soon.

Representatives of OPEC + on the 5th reduced oil production by 2 million barrels. This act had a strong effect on the oil market, and on Friday it came close to 100.00 for Brent. It is impossible to exclude further growth of quotations. We can approach the level of 110.00 within the current impulse.

The eighth package of EU sanctions includes a calculation formula for Russian oil. From December 5, we will be announced the price level above which Russian oil will not be available for purchase. It is already clear that everything will be done to harm those countries that dare to pay more. This is a serious negative for the Russian economy.

Europe somehow, but still will pass the winter despite the decline in natural gas supplies from Russia. Most likely, February and March will be difficult, and in order not to destroy their utility networks, Europeans will have to stop production, but in general, the EU will solve the problem. Only the economy will be sacrificed. No one is thinking about growth in 2023.

On Saturday, the Germans gathered in front of the Bundestag and declared their love for Russian resources, demanding their return. But the current chancellor is a little deaf to the aspirations of his people. He hears only the rhythm of the tap dance from across the ocean, and awkwardly jerks to it. And it would be necessary to behave more pragmatically.

USD/RUB:

The dollar/ruble pair has become a living dead. She continues to move, but does it extremely clumsily. Trading volumes have fallen, the market as we knew it until 2022 ceased to exist.

At this stage, it is possible to build only long-term forecasts based on the prospects for the Russian economy. It is clear that revenue from the sale of resources will fall in 2023. Defense spending will only grow, this is also obvious. At the same time, mobilization will worsen the quality of personnel in the field, which will affect the profits of companies. And this will lead to a drop in tax collection. You can forget about the budget surplus.

The deficit will be covered either by printing money, or by depreciating the ruble against the dollar. It is possible to issue bonds, but only domestic banks will buy them, and their possibilities are limited. The ruble, while maintaining the current negative trends, is doomed to fall.

We hope that over time new introductory entries will appear and the negative forecast for the economy and the ruble can be revised.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open short positions of asset managers than long ones. Sellers control the market. Over the past week, the difference between long and short positions of managers has decreased by 3.7 thousand contracts. At the same time, both sellers and buyers, like a week earlier, continued to leave the market. The spread between long and short positions is narrowing, the uncertainty in the market is growing.

Growth scenario: consider the December futures, the expiration date is December 14th. If support at 870.0 fails, the market will drop to 825.0 cents per bushel. Until we buy.

Fall scenario: in the current situation, it is necessary to hold the shorts that were open earlier, counting on a move to 825.0.

Recommendations for the wheat market:

Purchase: when approaching 825.0. Stop: 808.0. Target: 1070.0.

Sale: no. Who is in position from 925.0, move the stop to 922.0. Target: 825.0 cents per bushel.

Support — 822.4. Resistance — 945.2.

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Over the past week, the difference between long and short positions of managers increased by 4.5 thousand contracts. Both sellers and buyers, like a week earlier, left the market. Sellers closed their positions more actively. The spread between longs and shorts widened, and the bulls’ lead increased.

Growth scenario: consider the December futures, the expiration date is December 14th. The market range. If there is no upward movement, the bulls may not be able to keep the market at current levels. We hold longs, while we do not open new positions.

Fall scenario: we are waiting for a fall below the level of 660.0. if this happens, we will go short.

Recommendations for the corn market:

Purchase: no. Who is in position from 680.0, keep the stop at 660.0. Target: 750.0 cents per bushel.

Sale: after falling below 660.0. Stop: 683.0. Target: 550.0 cents per bushel.

Support — 671.6. Resistance — 692.0.

Soybeans No. 1. CME Group

Growth scenario: we are considering the November futures, the expiration date is November 14th. Soy continues to fall, which is natural in the current conditions: there is a lot of it. We don’t buy. Looking forward to lower levels.

Fall scenario: we do not open new shorts, we keep the old ones. The market is able to accelerate and fall by 30%.

Recommendations for the soybean market:

Purchase: no.

Sale: on the rise to 1400.0. Stop: 1440.0. Target: 1000.0 cents per bushel. Those who are in positions between 1420.0 and 1390.0 keep the stop at 1440.0. Target: 1000.0 cents per bushel.

Support — 1349.6. Resistance — 1391.2.

Sugar 11 white, ICE

Growth scenario: we consider the March futures, the expiration date is February 28. If there is a rollback to 18.20 and 18.10, it makes sense to buy. The current levels for long entry are too high.

Falling scenario: we can exit the falling channel up, which will lead to a move to 19.37. Out of the market.

Recommendations for the sugar market:

Purchase: on rollback to 18.20 and 18.10. Stop: 17.60. Target: 19.37 cents a pound.

Sale: no.

Support — 18.05. Resistance — 19.37.

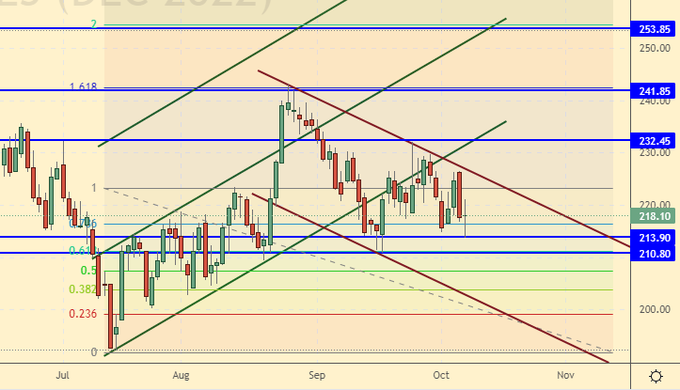

Сoffee С, ICE

Growth scenario: consider the December futures, the expiration date is December 19. So far, the bulls are holding on, but there is no pronounced advantage. We hold longs. Those interested can buy here.

Fall scenario: holding shorts. Due to Red Thursday, sellers have an advantage.

Recommendations for the coffee market:

Purchase: no. Who is in positions from 210.0, 221.00 and 235.00, keep the stop at 212.00. Target: 350.00 cents per pound.

Sale: no. Who is in position from 220.0, keep the stop at 228.00. Target: 150.00 cents per pound.

Support — 213.90. Resistance is 232.45.

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Over the past week, the difference between long and short positions of managers increased by 25.7 thousand contracts. The change is significant. Buyers actively entered the market, sellers closed their positions. The spread between long and short positions widened. The bulls have tightened their grip on the market.

Growth scenario: consider the October futures, the expiration date is October 31. Most likely we will touch the 100.00 level and retreat down for a few days. In this situation, it makes sense to wait for a correction to the level of 95.00 and buy.

Fall scenario: sellers left their positions after OPEC cut production. We do not sell.

Recommendations for the Brent oil market:

Purchase: when approaching the levels of 95.00 and 90.00 dollars per barrel. Stop: 87.00. Target: 110.00. dollars per barrel. Count the risks.

Sale: no.

Support — 90.39. Resistance is 100.43.

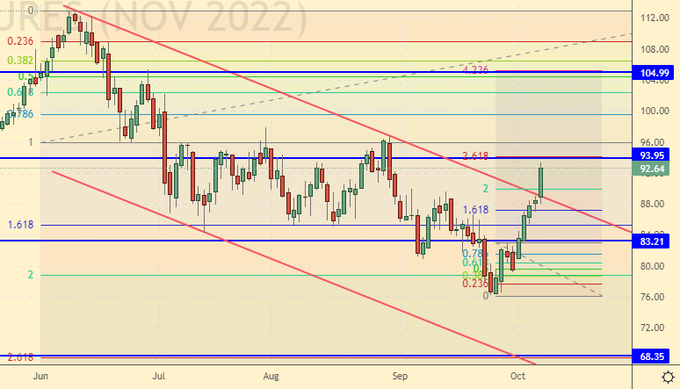

WTI. CME Group

US fundamental data: the number of active drilling rigs decreased by 2 units and now stands at 602 units.

Commercial oil reserves in the US fell by -1.356 to 429.203 million barrels, while the forecast was +2.052 million barrels. Inventories of gasoline fell -4.728 to 207.46 million barrels. Distillate inventories fell -3.443 to 110.916 million barrels. Inventories at Cushing rose by 0.273 to 25.956 million barrels.

Oil production has not changed and is 12 million barrels per day. Oil imports fell by -0.502 to 5.947 million barrels per day. Oil exports fell by -0.095 to 4.551 million barrels per day. Thus, net oil imports fell by -0.407 to 1.396 million barrels per day. Oil refining increased by 0.7 to 91.3 percent.

Gasoline demand rose by 0.64 to 9.465 million barrels per day. Gasoline production increased by 0.389 to 10.014 million barrels per day. Gasoline imports fell by -0.045 to 0.48 million barrels per day. Gasoline exports fell -0.189 to 0.796 million bpd.

Demand for distillates fell by -0.073 to 4.105 million barrels. Distillate production increased by 0.23 to 5.188 million barrels. Distillate imports fell -0.013 to 0.081 million barrels. Exports of distillates rose by 0.369 to 1.656 million barrels per day.

Demand for petroleum products increased by 0.061 to 20.831 million barrels. Production of petroleum products increased by 0.74 to 22.545 million barrels. Imports of petroleum products fell by -0.469 to 1.372 million barrels. Exports of petroleum products fell by -0.277 to 6.061 million barrels per day.

Demand for propane rose by 0.012 to 0.93 million barrels. Propane production fell -0.058 to 2.457 million barrels. Propane imports fell by -0.03 to 0.082 million barrels. Propane exports fell by -0.09 to 1.385 million barrels per day.

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Last week the difference between long and short positions of managers increased by 19.7 thousand contracts. The change is significant. Sellers massively left the market, buyers entered positions. The spread between longs and shorts widened, and the bulls’ lead increased.

Growth scenario: we are considering the November futures, the expiration date is October 20. After the growth, we are waiting for a rollback to the level of 88.00. We will buy from him.

Fall scenario: The market turned up. Until we sell.

Recommendations for WTI oil:

Purchase: when approaching 88.00 and 84.00. Stop: 82.00. Target: 104.00.

Sale: no.

Support — 83.21. Resistance is 93.95.

Gas-Oil. ICE

Growth scenario: we are considering the November futures, the expiration date is November 10. Turned up. We are waiting for a rollback to the level of 1055.00 and buy.

Fall scenario: hopes for a fall have faded. We do not sell.

Gasoil recommendations:

Purchase: on a rollback to 1055.00 and 1000.00. Stop: 960.00. Target: 1320.00.

Sale: no.

Support — 1051.50. Resistance is 1319.50.

Natural Gas. CME Group

Growth scenario: switched to the November futures, the expiration date is October 27th. We continue to buy. Europe will take all the gas from the US.

Fall scenario: there are no opportunities to enter shorts. Out of the market.

Recommendations for natural gas:

Purchase: now. Stop: 6.200. Target: 15.000!!! Who is in position from 6.800, keep the stop at 6.200. Target: 15.000!!!

Sale: no.

Support — 6.303. Resistance is 7.712.

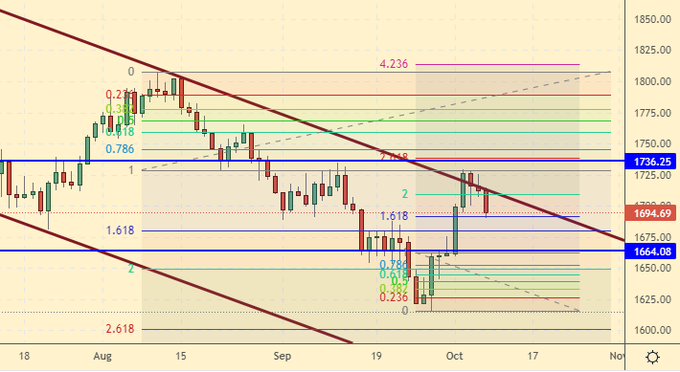

Gold. CME Group

Growth scenario: The market failed to reach the target at 1736. Sellers may gain the upper hand again. If you went long from 1710, close your positions. We are not opening new positions.

Fall scenario: For now, it makes sense to insist on selling. The dollar continues to be strong. Including because of the strong labor market in the United States. We go short again.

Recommendations for the gold market:

Purchase: no.

Sale: now. Stop: 1718. Target: $1480 per troy ounce.

Support — 1664. Resistance — 1736.

EUR/USD

Growth scenario: the pair continues to remain in the falling channel. We don’t buy.

Fall scenario: we will sell again. The target at 0.8600 continues to beckon us. This move cannot be skipped.

Recommendations for the EUR/USD pair:

Purchase: no.

Sale: now. Stop: 0.9970. Target: 0.8600.

Support — 0.9632. Resistance is 1.0004.

USD/RUB

Growth scenario: Here we should look for opportunities to enter the long, as we moved away from the lows. We see that the sellers have lost their advantage.

Fall scenario: we will not sell. Traders who bet on the weakening of the dollar were forced to flee. In the current macroeconomic situation, the market is more likely to rise to 74.00 than to try to go below 50.00.

Recommendations for the dollar/ruble pair:

Purchase: now and on the fall to 59.00. Stop: 57.40. Target: 74.00. Count the risks.

Sale: no.

Support — 57.31. Resistance — 62.74.

RTSI

Growth scenario: consider the December futures, the expiration date is December 15th. The parade of Western sanctions does not stop. Restrictions on oil prices, as well as a ban on the purchase of steel products in Russia, make the background more and more gloomy. We don’t buy.

Fall scenario: we will continue to keep shorts from 118000. Targets at 80000 and 50000 points remain. Those who wish can increase their positions here. Most likely we will continue to fall.

Recommendations for the RTS index:

Purchase: no.

Sale: no. Who is in position from 118000, move the stop to 112000. Target: 80000 (50000).

Support — 95140. Resistance — 105320.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.

Ваш комментарий

|

|

|